Understanding Joint Venture Opportunities in Property Development

Joint venture property development is becoming an increasingly popular way for UK developers, investors and landowners to unlock the full potential of a site while sharing risk and maximising returns. In essence, property development joint ventures bring together complementary skills, capital and expertise, often creating outcomes that would be impossible to achieve alone.

From an architectural perspective, joint ventures offer even greater potential. When design innovation, planning expertise and strategic project management are integrated from the outset, the results can be more profitable, more sustainable and better tailored to market demand.

What Is a Joint Venture in Property Development?

Defining property development joint ventures

A property development joint venture (JV) is a formal collaboration between two or more parties to undertake a development project. Each party contributes resources, such as land, capital or professional expertise, and shares the risks and rewards proportionally.

In the UK, these arrangements can be flexible, from informal agreements to legally binding structures that cover governance, financing and profit distribution.

Common structures and arrangements in the UK market

- Contractual JVs – Simple agreements without creating a separate legal entity.

- Limited companies – A new corporate vehicle owned jointly by the partners.

- Limited liability partnerships (LLPs) – Offering flexibility with reduced personal liability.

Why Consider Joint Venture Opportunities in Property?

Combining resources for higher-value developments

Pooling land with finance, or pairing funding with professional expertise, can turn a modest scheme into a landmark development. This synergy often unlocks planning potential that might otherwise be missed.

Spreading risk and improving funding access

Joint ventures distribute the financial burden and can make lenders more comfortable, as risk is diversified across multiple stakeholders.

Leveraging specialist skills, from finance to architecture

Incorporating a specialist such as an architect ensures not only planning compliance but also a design that maximises saleable space, improves marketability and enhances end value.

Architect Joint Venture Partnerships, The Design Advantage

Architect joint venture partnerships offer a competitive edge by embedding design thinking into every stage of development.

Leveraging specialist skills, from finance to architecture

Incorporating a specialist such as an architect ensures not only planning compliance but also a design that maximises saleable space, improves marketability and enhances end value.

Architect Joint Venture Partnerships, The Design Advantage

Architect joint venture partnerships offer a competitive edge by embedding design thinking into every stage of development.

How architects add value beyond planning approval

RIBA Chartered architects don’t just create drawings. They assess viability, engage with planning authorities, and design to optimise the development’s footprint and appeal.

Maximising land use and ROI through creative design

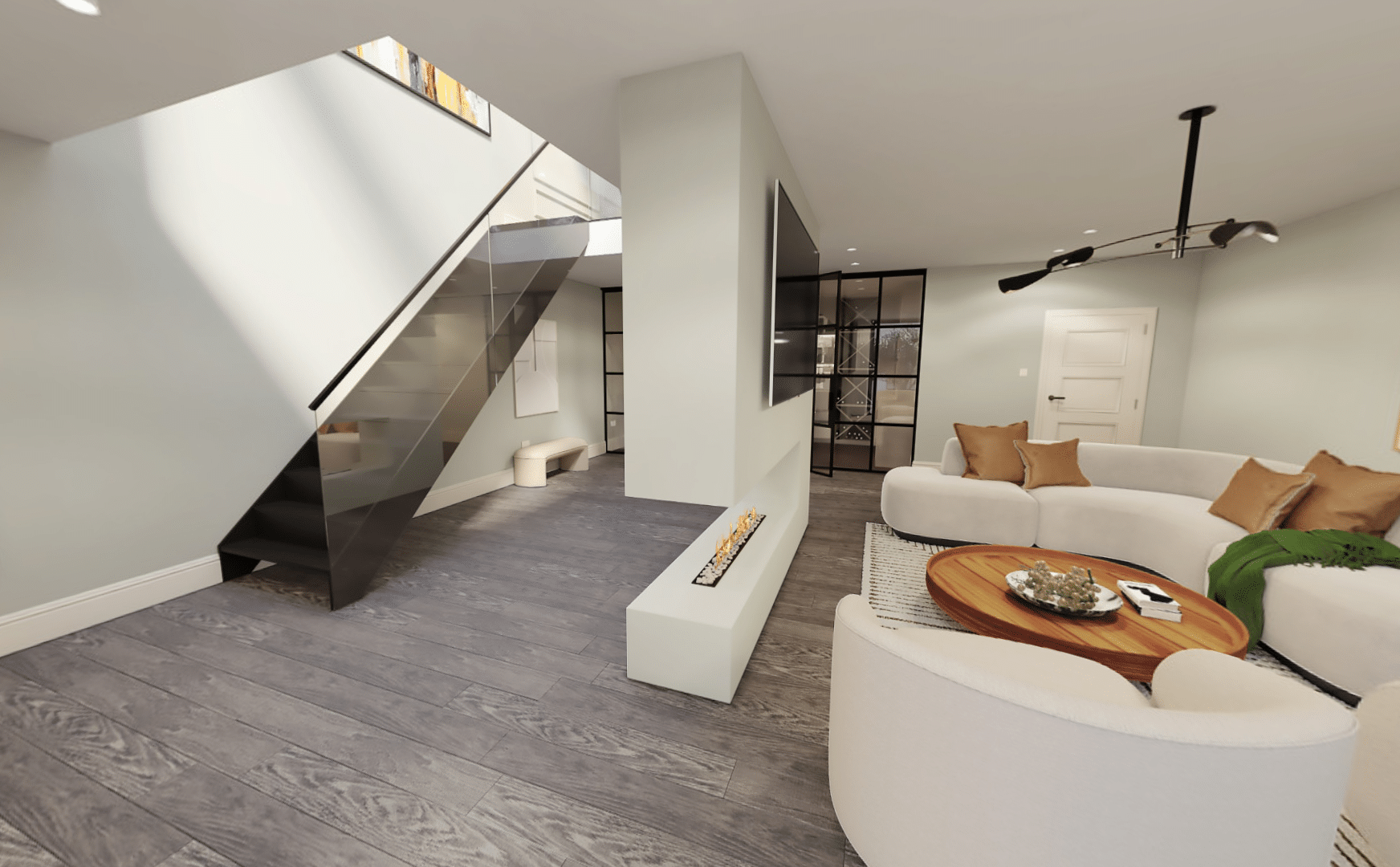

Through innovative layouts, clever space optimisation and strategic massing, an architect can increase the net sellable area, directly impacting profitability.

Sustainability and future-proofing in joint venture projects

Integrating energy efficiency, low-carbon materials and adaptable layouts ensures the project remains attractive to future buyers and meets evolving regulations.

Common Types of Property Development Joint Ventures

| JV Structure | Key Features | Pros | Cons |

| Contractual Agreement | Simple legal contract | Low cost, flexible | Less formal protection |

| Limited Company | Separate legal entity | Clear governance, liability protection | More admin, compliance costs |

| LLP | Flexible partnership | Tax efficiency, limited liability | Requires agreement on management |

How to Structure a Successful Joint Venture

Getting the structure right at the outset is the single most important step in ensuring your joint venture property development runs smoothly and profitably. A well-structured JV protects all parties, minimises misunderstandings and sets clear expectations for every stage of the project.

Key legal considerations and governance

A robust JV agreement should be drafted with the help of experienced solicitors who understand both property law and commercial partnerships. This document is the foundation of the relationship and should cover:

- Ownership proportions – How the equity in the project is divided, often reflecting each party’s contribution (e.g. land, capital or professional expertise).

- Profit and loss sharing – The agreed split of any surplus or deficit once the development is completed and sold or refinanced.

- Decision-making processes – The voting structure and thresholds for major decisions, from budget approval to design changes.

- Exit clauses – Clear terms for how a party can withdraw, sell their stake or be replaced, along with buy-out formulas and valuation methods.

- Dispute resolution mechanisms – Mediation or arbitration clauses that set out how conflicts will be handled without derailing the project.

- Intellectual property rights – Especially important in architect joint venture partnerships, ensuring designs, plans and branding are protected.

Pro tip: Without precise governance terms, even well-intentioned projects can stall due to disagreements over scope, costs or timing.

Financing options and joint venture funding models

Securing finance for a JV is often easier than for solo projects, as multiple stakeholders spread the risk. Common funding routes include:

- Bank development finance – Traditional loans based on a percentage of the gross development value (GDV), often requiring personal guarantees.

- Mezzanine funding – A hybrid of debt and equity that can top up bank finance but comes with higher interest rates.

- Equity contributions from partners – Direct capital from JV members, reducing reliance on external lenders and improving flexibility.

- Private investor syndicates – Groups of investors contributing capital in return for a fixed or variable return.

- Bridging loans – Short-term finance used to secure a site quickly before refinancing into longer-term development finance.

It’s vital to align the finance strategy with the project timeline, ensuring funds are available when required for land purchase, construction and marketing.

Defining roles, responsibilities and exit strategies

Ambiguity kills momentum. Clearly assigning duties ensures accountability and avoids duplication or neglect. Typical role divisions include:

- Planning and design – Usually led by the architect and planning consultant.

- Construction management – Overseen by the developer or project manager.

- Finance and administration – Handled by a finance partner or appointed accountant.

- Marketing and sales – Managed by a dedicated sales agent or marketing partner.

An exit strategy should also be defined from day one. Will you sell all units immediately upon completion, retain them for rental income, or refinance and hold? Agreeing on this early prevents last-minute disputes when market conditions or personal circumstances change.

Risks and Challenges in Property Development Joint Ventures

While property development joint ventures offer substantial benefits, they also carry inherent risks. Identifying these early and building safeguards into your agreement — is essential for protecting your investment and relationships.

Disputes and conflict resolution

Misaligned expectations are one of the most common causes of JV breakdowns. Disagreements might arise over:

- Project scope and design changes

- Budget overruns and cost allocation

- The pace of decision-making

- The timing of profit distribution

A strong JV agreement should include clear dispute resolution procedures, such as:

- Mediation clauses – Requiring parties to work with an independent mediator before pursuing legal action.

- Arbitration options – Faster and less public than court proceedings, often with binding outcomes.

- Deadlock provisions – Setting out how to resolve situations where neither side will compromise (e.g. a buy-out mechanism).

Architect insight: Early collaboration on design intent and feasibility can prevent scope creep, which is a major cause of disputes.

Funding shortfalls and delays

Unexpected cost increases, contractor issues or slow sales can create cashflow pressure. Left unaddressed, these issues can stall construction or reduce quality to cut costs. To mitigate:

- Build contingency finance into your funding model (typically 5–10% of total costs).

- Use realistic build programmes that factor in potential weather delays, supply chain issues and planning approval timelines.

- Ensure funding is drawn down in phases tied to key milestones, avoiding idle capital or premature spending.

Protecting intellectual property and design rights

In architect joint venture partnerships, the intellectual property (IP) created — such as drawings, 3D models and branding — is a valuable asset. Without protection, designs can be misused by partners or third parties.

Best practices include:

- Explicitly stating IP ownership in the JV agreement.

- Licensing terms that define how partners may use the designs during and after the project.

- Including a clause requiring consent for any modifications or reuse of the design.

This not only safeguards creative work but also maintains brand integrity and ensures the development remains aligned with planning approvals.

AURA’s Approach to Joint Venture Property Development

The Concept Feasibility Package

Aura’s Concept Feasibility Package evaluates a site’s potential, including planning likelihood, design options and projected returns.

End-to-end support, from planning to build completion

Aura manages every stage, concept, planning, technical design, contractor procurement and site monitoring, ensuring design intent is maintained.

For a full view of AURA Homes’ diverse property development work, including similar high-impact schemes, see our Property Development Projects page.

Steps to Start Your Joint Venture Project

Starting a joint venture property development requires a balance of strategic planning, relationship building, and rigorous due diligence. Following a structured process increases the likelihood of a smooth, profitable project.

1. Initial feasibility and partner selection

The first step is to determine whether the site – or your idea – is commercially viable. This includes:

- Site appraisal – Assess location, access, planning constraints and potential resale/rental demand.

- Financial modelling – Project development costs, sale values and potential return on investment (ROI).

- Planning review – Identify any planning policies, restrictions or opportunities that could influence design.

When selecting JV partners, consider:

- Alignment of goals, timelines and exit strategies.

- Complementary resources (e.g. landowner + developer + architect).

- Track record and financial credibility.

Tip: AURA’s Concept Feasibility Package provides developers and landowners with a professional viability assessment before any formal commitment is made.

2. Drafting the agreement and securing finance

Once you’ve agreed to work together in principle, formalise the arrangement:

- Legal agreement – Engage a solicitor experienced in property JVs to draft terms covering governance, profit share, dispute resolution and exit provisions.

- Funding plan – Identify the financing route: bank development finance, mezzanine funding, private investors or equity contributions.

Risk mitigation – Build contingency allowances into both budget and timeline to protect against overruns or delays.

3. Moving from design concept to construction

With the JV and finance in place, the project moves into delivery:

- Concept design – Develop initial layouts, massing and visualisations to meet planning and market requirements.

- Planning approval – Submit applications, liaising with planning officers to address concerns and improve approval chances.

- Technical design – Prepare detailed construction drawings and specifications.

- Procurement – Tender to contractors and suppliers, ensuring competitive and transparent pricing.

Construction & monitoring – Oversee the build, ensuring it aligns with the agreed design, budget and quality standards.

Final Thoughts: Is a Joint Venture Right for Your Development?

Joint venture opportunities in property can transform a development vision into reality, but they require careful structuring, clear agreements and the right expertise. Partnering with an architect-led team like Aura Homes ensures your project is optimised from day one, reducing risk, maximising ROI and delivering sustainable, high-quality developments.

If you’re considering a joint venture, discover how AURA’s award-winning architects can help bring your project to life. Visit our Property Development Services page to explore how we can support you from concept to completion.